As people live longer and the cost of living continues to rise, today’s retirees increasingly face the prospect of outliving their income.

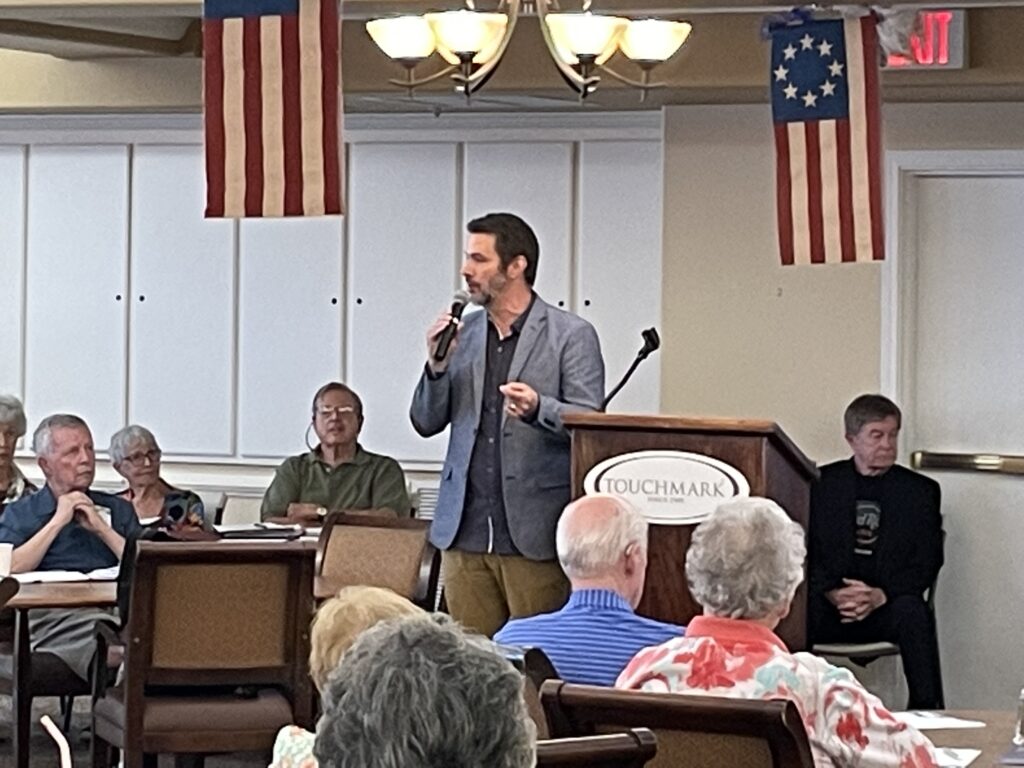

That was the key message Aaron McMurray, Chief Strategy Officer of Innovia Foundation, delivered at Touchmark on South Hill retirement community on June 27. Roughly 60 residents gathered for the presentation as part of Touchmark’s monthly resident’s council meeting.

Read for more information about a planned gift to the Waterford Residents Legacy Fund

Through Innovia, Touchmark residents established the Waterford Residents Legacy Fund which organizers hope will one day serve as a rainy-day fund for residents potentially experiencing financial need. The newly established fund was seeded with an anonymous $1,000 contribution, and later, an anonymous $10,000 contribution was placed in the fund.

The current fund balance is just over $25,000. Fund organizers have set a goal of reaching the $500,000 threshold. At that amount, at least $20,000 would be available to grant on an annual basis for assistance to residents.

To build the fund quicker, Aaron asked residents to consider leaving some of the following appreciated assets in their will:

- IRAs

- Life insurance policies

- Securities

- Stocks

“What many people don’t realize is that those assets can be really effective for gifting into a fund like this both to avoid taxes and make an incredible difference for future residents here at Touchmark,” he said.

The Waterford Residents Legacy Fund started when residents of the Touchmark community became concerned about some residents outliving their finances forcing them to move.

Once the fund reaches its targeted goal, to qualify for assistance, residents of Touchmark must submit a confidential application to Innovia Foundation where it will be reviewed by foundation staff. Residents must have lived at Touchmark for three consecutive years and must also be willing to move into a less expensive unit if one is available.

“Through the years, Innovia Foundation has become a trusted partner working side-by-side with people as they consider their end-of-life generosity and legacy planning,” Aaron concluded.